Responsible investment for long term value

SHARE PRICE

STORES

*Includes one store for which the company has signed a conditional purchase to buy

PORTFOLIO VALUE

WAULT

Our sustainability story so far

January 2026

SUPR receives a 'Prime' rating for corporate ESG performance from ISS STOXX.

September 2025

SUPR Awarded EPRA sBPR Gold Award

September 2025

Living Wage Employer Accreditation

August 2025

UN Global Compact: Signatory Status

June 2025

Climate Transition Plan Published

October 2024

First CDP Response Submitted

September 2024

SUPR's GHG independently assured for the first time.

September 2024

SUPR awarded EPRA sBPR Most Improved and Silver Awards

March 2024

SUPR has its Science Based Targets approved and validated

September 2023

SUPR publishes its first fully aligned TCFD Report, against all 11 TCFD recommendations, in its Annual Report and Accounts.

September 2023

SUPR publishes its first standalone annual Sustainability Report

July 2022

SUPR Board Establishes an ESG Committee, Chaired by Frances Davies.

September 2021

SUPR adopts the UN Sustainable Development Goals as a reporting framework.

July 2017

Supermarket Income REIT listed on the London Stock Exchange.

Portfolio progress

16%

38%

charging points installed

2050

Net Zero Target

EV charging and solar installation percentages calculated as UK and France combined as at 30 June 2025.

Our Sustainability STRATEGY

Pillar 1: Climate and

Environment

Reduce our emissions to acheieve a net zero carbon portfolio and mitigate the environmental impacts of our assets.

Pillar 2: Tenant and Community Engagement

Ensure our assets enhance the communities in which they are located.

Pillar 3: Responsible

Business

Strengthen ESG performance and uphold responsible business practices to deliver long-term value.

UN SUSTAINABLE DEVELOPMENT GOALS

Our sustainability pillars align to multiple UN Sustainable Development Goals, with a particular focus on:

Our sustainability forumla

Our purpose

We create sustainable long-term value through owning high-quality grocery-anchored real estate that is critical to national food infrastructure and serves local communities as essential retail.

We believe that real estate is an asset class where Sustainability can go hand-in-hand with attractive, long-term returns for investors.

Our sustainability strategy framework is built on three key pillars:

Climate and environment

- We are committed to enhancing the environmental sustainability of our assets.

- Improving the energy performance of our buildings and reducing greenhouse gas emissions are core elements of our sustainability strategy. We are proud to support the Science based Targets Initiative (SBTi), which provides a robust standard for emissions reductions targets and independent validation. We have set SBTi validated and approved emissions targets which are detailed below.

Tenant and community engagement

- We are committed to ensuring our assets enhance the communities in which they are located. Engagement and partnership with out tenants is fundamental to our sustainability strategy and achieving our goals.

- We believe that strong relationships with our tenants and alignment of sustainability goals will facilitate and maintain a robust portfolio that can adapt to future challenges and optimise impact opportunities.

Responsible business

- We believe that responsible business practices and strong ethics in governance are key to long-term success and value creation. We are committed to upholding strong ethics and integrity including by managing conflicts of interest, maintaining clear and up to date governance and ESG policies and transparent reporting. This commitment is also aligned with the 10 Principles of the UN Global Compact, of which we are participants.

- We recognise that the talent and capability of our people is essential to being able to deliver on our purpose. Attracting, retaining and developing our employees is therefore a key priority for the business. We are also proud to be an accredited Living Wage Employer.

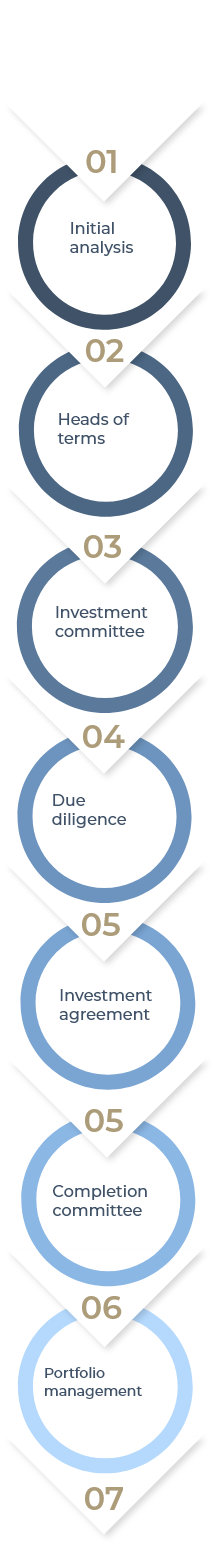

Responsible investment process

Our approach to sustainability is underpinned by the Board’s commitment to good stewardship and creating long-term value for our stakeholders.

ESG Committee:

To support the integration of ESG priorities into the execution of the investment strategy, the Board established a dedicated ESG Committee in May 2022.

The ESG Committee serves as an independent and objective party to:

- Monitor the integrity and quality of the Company’s ESG strategy.

- Ensure that the ESG strategy is integrated into the Company’s business plan, corporate values, and objectives, fostering a culture of responsibility and transparency.

- Review and approve the Company’s annual ESG Reporting.

Reaching Net Zero

Emissions

Whilst our energy use and emissions are minimal, we recognise the importance of having visibility across our value chain. Emissions from our downstream leased assets (Scope 3 emissions) contribute to the majority of our emissions profile. We continue to work with our tenants to improve the quality of our emissions-related data and improve the percentage of actual data used in our calculations.

Science based targets

In late 2023 SUPR submitted its Science Based emission reduction targets to the Science Based Target Initiative (SBTi) for validation. Our targets were approved and validated in March 2024:

- A commitment to reach net zero GHG emissions across the value chain by FY2050

- A commitment to reduce absolute Scope 1 and 2 GHG emissions 42% FY2030 from a FY023 base year

- A commitment to reduce absolute Scope 1, 2 and 3 GHG emissions by 90% by FY2050 from a FY2023 base year

Reaching these targets will require us to engage more closely with our tenants, many of whom have similarly ambitious climate targets, to support their decarbonisation strategies.

Energy Efficiency

Energy Performance Certificates (EPC) provide ratings for the energy efficiency of buildings. All our assets have an EPC rating, whether they are directly managed by us or are leased as full repairing and insuring (FRI) contracts.

We are committed to improving the energy efficiency in both circumstances, either directly, or by supporting our tenants to implement their own initiatives. We engage regularly with our tenants to discuss their targets and goals to achieve this.

We have set energy performance targets in line with the proposed UK Government‘s Minimum Energy Efficiency Standards (MEES) in tenanted non-domestic properties by requiring all assets to be EPC C by 2027, and EPC B by 2030.

TCFD

Our first Task Force on Climate-related Financial Disclosures (TCFD) report was published in 2022, joining more than 2,800 organisations in demonstrating a commitment to building a more resilient financial system and safeguarding against climate risk through better disclosures.

Read our most recent TCFD and Streamlined Energy and Carbon Reporting (SECR) Reports in our latest Annual Report and Accounts. See Investor Centre page.