We manage a unique portfolio

Our handpicked, geographically diverse portfolio is a critical part of the UK’s feed the nation infrastructure.

SHARE PRICE

STORES

*Includes one store for which the company has signed a conditional purchase to buy

PORTFOLIO VALUE

WAULT

A key pillar of our investment strategy is to invest in omnichannel stores. Omnichannel supermarkets provide in-store shopping, but also operate as last mile, online grocery fulfilment centres for both home delivery and click and collect.

We have handpicked a leading portfolio of supermarket investment assets.

We are the largest landlord of omnichannel grocery stores in the UK, offering a combination of attractive, secure and growing income with potential for long term capital growth.

Our strategy is aligned with the future model of grocery: capitalising on the long-term structural trend toward growing omnichannel operations.

Our investment strategy is simple. We seek to own and actively manage a leading portfolio of handpicked, high-quality supermarkets which deliver low-risk and growing income returns that are resilient through economic cycles. This is achieved through a focus on omnichannel stores, critical to the operations of the UK’s leading grocers.

The grocery market is changing. The developing online market adds a new dimension to the long established, traditional grocery market. Fulfilment of online orders relies on a network of existing, omnichannel stores. These act as distribution hubs for online business, enable click and collect and also fulfil traditional in-store shopping.

For the operator. The economies of scale resulting from a near doubling in online grocery penetration has halved delivery costs from omnichannel stores. Store picking productivity (pick and pack rates per hour), is approaching equivalence to highly automated centralised fulfilment centres (CFCs). However, the distributed nature of the omnichannel stores means that they are usually far closer to customers than CFCs, resulting in increased delivery efficiency and lower delivery costs. Omnichannel stores facilitate seamless integration across both online and offline sales channels and can adjust capacity rapidly to cater for changing consumer behaviour.

For the customer. Adding online fulfilment to a store also creates a better in-store experience for the customer. Increased turnover (from online) leads to much fresher produce on the shelves. Picking in-store to send for delivery also means there are more staff members on the shop floor to help customers. Omnichannel stores tend to score higher on customer satisfaction surveys. This increase in satisfaction can eventually lead to an increase in physical store sales.

This virtuous circle effect of an omnichannel supermarket is driving the global convergence towards omnichannel being the optimal future model of grocery.

We aim to own supermarkets that we believe will be sustainable as grocery sites for the long term. We characterise these ‘future-proofed supermarkets’ by the following features:

We target tenanted standing assets – existing stores with a multi-year track record of performance. The investment is thereby income producing from the point of purchase, with the tenant remaining committed to the existing lease terms.

We aim to provide investors with a long-term and secure income stream. We acquire supermarket property with long, inflation linked leases, targeting a portfolio average of 15 years to expiry or first break. The resulting income profile of the assets allows us to target a progressive dividend – we have increased our dividend every year since IPO.

The grocery sector has proven its resilience and critical role in the UK economy through many economic cycles. During the COVID pandemic, supermarkets were able to overcome huge logistical challenges, remaining open and stocked, feeding the nation. The leading multi-channel operators were also able to scale their online delivery systems rapidly for customers because of their existing omnichannel store network. Grocery volumes and online penetration remain above pre-pandemic levels and continue to grow.

More recently, operators have been able to pass on cost rises to consumers, with UK grocery market sales growing in line with inflation. This dynamic underscores one of the key advantages of investing in this non-discretionary spend sector: demand remains resilient, enabling operators to preserve their margins over the long term. This supports affordable rental levels, even in a challenging macroeconomics environment.

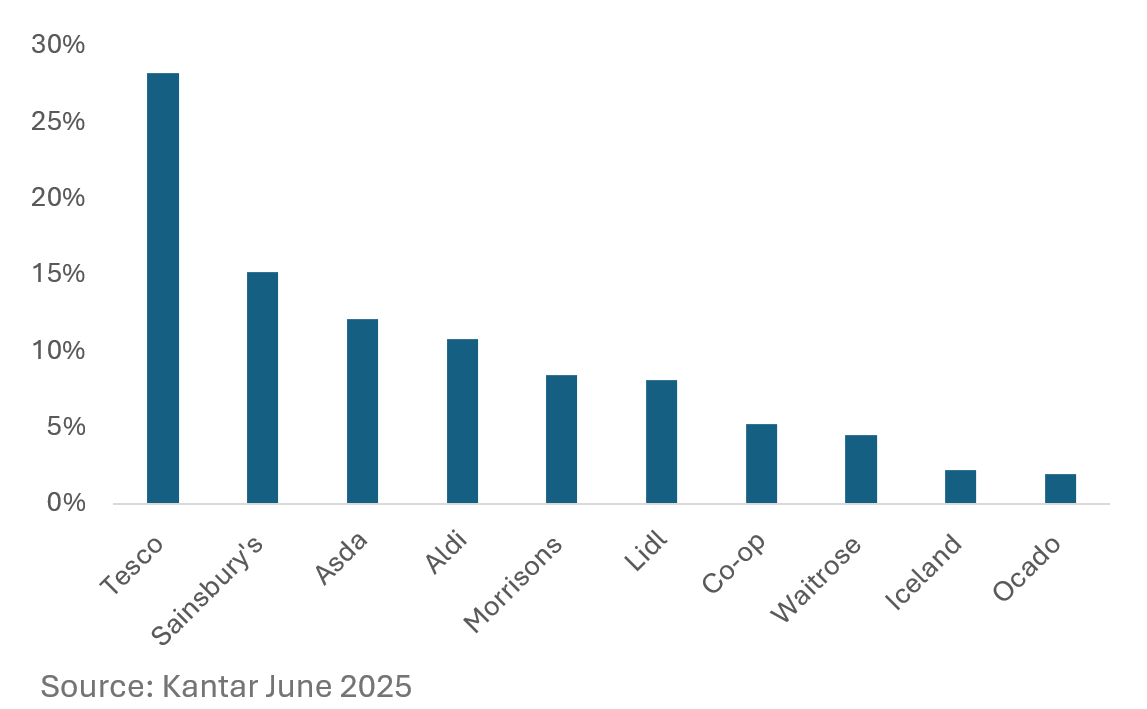

The UK market is highly concentrated, with the six largest grocers controlling over 80% of the UK grocery space.

The UK grocery market continues to be dominated by the likes of Tesco and Sainsbury’s who boast a combined market share of over 40%[1]. Both leading grocers has multi-billion-pound revenues, established consumer brands and strong credit covenants. Together, they serve customers through more than 5,000 stores in the UK[2].

These operators play an integral role in the UK market, successfully operating a strategy of price and assortment management through a multi-channel brand focused strategy.

Following the private equity takeovers of Asda and Morrisons, both operators have struggled to maintain market share as increased debt costs and senior management turnover disrupted operations and hampered price competitiveness. However, efforts to lower prices, improve customer engagement and streamline operations indicate a turning point for Asda and Morrisons’ performance, with both operators stabilised and positioned for growth.The second largest group of operators is the lower-price grocery operators (the “Discounters”), such as Aldi and Lidl. They continue to grow through ambitious store opening plans which have captured a combined market share of approximately 19%[1]. Their lower cost, low-margin business model requires simplicity and standardisation of range, which is attractive to their customers but at odds with the fulfilment intricacies and product assortment required in online grocery.

(1) Kantar: June 2025

(2) Tesco and Sainsbury’s FY25 Results

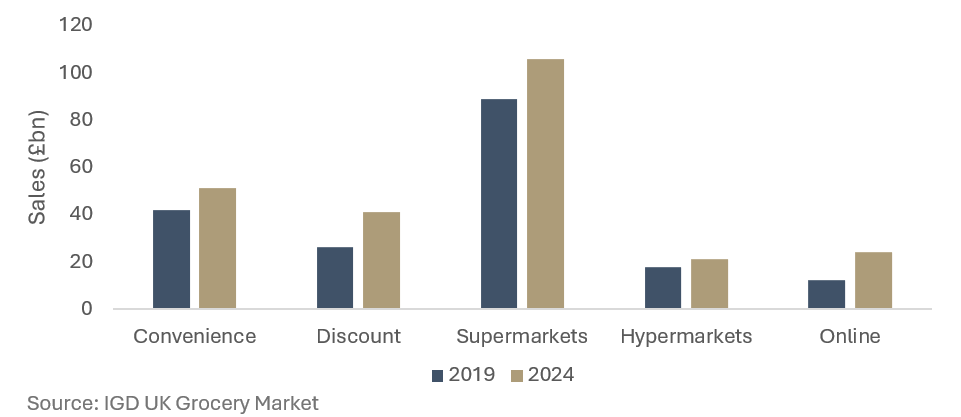

As illustrated below, the supermarket channel is the dominant sales channel in the UK grocery market and online grocery is the fastest growing.

Over the last five years, the supermarket channel has remained the most dominant sales channel in the UK grocery market, accounting for approximately 12% of the total market, demonstrating a permanent shift in consumer behaviours following the pandemic. Omnichannel supermarkets remain mission critical for the fulfilment of online sales due to their proximity to customers, existing supply chain infrastructure and the full product ranges that these stores carry to maximise product availability for online orders.

While sales growth from the discounters Aldi and Lidl over the last five years has attracted attention, this is primarily driven by new store openings. When adjusting for store footprint, discounter sales trail behind that of full product range supermarkets.

Large format omnichannel stores require multiacre sites, close to densely populated areas, with good transport links. A lack of available space, strict planning regulations and increased construction costs provide significant barriers to entry for developing new store space. The positive impact of increased sales being fulfilled through existing supermarket sites should result in improved sales densities and enhanced store-level profitability. From a landlord’s perspective, this should deliver increasingly affordable rental levels for tenants and a strong foundation for rental increases in the future.Supermarket lease agreements are often long dated and inflation linked. Original lease tenures range from 15 to 30 years without break options. Rent reviews often link the growth in rents to an inflation index such as RPI, RPIX or CPI (with caps and floors), or, alternatively, may have fixed annual growth rates or open market rent reviews.

An open market review means that the rent is adjusted (usually upwards only) to reflect the rent the landlord could achieve on a letting in the open market. Such rent reviews take place either annually or every five years, with the rent review delivering an increase in the rent at the growth rate, compounded over the period.

Landlords usually benefit from “full repairing and insuring leases”. These are lease agreements whereby the tenant is obligated to pay all taxes, building insurance, other outgoings and repair and maintenance costs of the property, in addition to the rent and service charge.

Operators often have the option to acquire the leased property at the lease maturity date at market value. Furthermore, to ensure that the operator does not transfer its lease obligation to other parties, assignment of the lease by the tenant is restricted.

The traditional in-store weekly shop accounts for over 60% of all UK grocery sales and is the dominant channel for customers acquiring groceries. Each month the average UK household will spend over £400 on groceries, with a total grocery retail market value of over £242 billion annually which is fulfilled from the UK’s network of over 4,450 supermarkets.

Click and collect now represents a significant portion of the online grocery market and is expected to continue to grow year on year due to its convenience for customers. Operators continue to invest in modern click and collect systems, offering dedicated drive throughs with number plate recognition, to enhance the customer experience. Omnichannel supermarkets enable operators to offer click and collect to their customers at convenient, local sites.

Delivering grocery from a well located omnichannel supermarket achieves a game changing saving in the cost of online fulfilment. Delivery cost is the dominant factor in online grocery fulfilment costs. Omnichannel stores have been proven to be the optimal method of online fulfilment due to their proximity to customers, reducing delivery time and cost.

SUPR acquired the Sainsbury’s in Melksham in January 2021 for £35.1m. The store was originally developed in 1997 and was subsequently extended and refurbished in 2011. The store houses a purpose-built online fulfilment facility which supports Sainsbury’s online grocery deliveries across the region. The store services in-store shoppers with parking provisions for 290 vehicles and an 8-pump petrol filling station.

SUPR acquired the Sainsbury’s supermarket in Ashford in August 2017 for £79.8m. The store was originally developed in the early 1990’s and subsequently extended and refurbished in 2011. The store has a net sales area of 71,732 sqft as well as a parking provision for over 700 vehicles and a petrol filling forecourt. It has a purpose-built online fulfilment facility which fulfils the omnichannel shopping model and enables the store to service a large catchment of shoppers both online and in-store.

SUPR acquired an Aldi and an M&S Foodhall on the same site in Liverpool in August 2021 for £10.2m combined. Both stores opened in 2016 and share access to 120 parking spaces. The Aldi store has a net sales area of 13,000 sqft, and the M&S has a net sales area of 10,000 sqft. Both service a large catchment in an ideal location.

Our handpicked, geographically diverse portfolio is a critical part of the UK’s feed the nation infrastructure.

Key shareholder information including latest results and news announcements, share and dividend centre, consensus and research and key events.

Details of our investment strategy, key characteristics, asset management and market backdrop.

We’re delighted to announce Jamie Cowen has been appointed as Strategy Director. Jamie brings over 30 years’ experience in grocery r...

January 15, 2026

SUPR announces that it has completed the acquisition of three supermarkets in the UK for a total purchase price of £97.6 million, at an ave...

December 24, 2025

Supermarket Income REIT plc (LSE: SUPR) announces that it is has completed £40.9 million of acquisitions that are accretive to earnings and...

December 10, 2025

Supermarket Income REIT plc (LSE: SUPR, JSE: SRI), announces an update on its joint venture (the “JV”) with funds managed by Blu...

November 20, 2025

Supermarket Income REIT plc (LSE: SUPR, JSE: SRI) is pleased to announce that it has completed the acquisition of a portfolio of 201 Ca...

November 14, 2025

SUPR has committed to reaching net-zero greenhouse gas ("GHG") emissions across our value chain by 2050.

June 11, 2025

We’re delighted to announce Jamie Cowen has been appointed as Strategy Director. Jamie brings over 30 years’ experience in grocery real estate investment and operations, as well as strong relationships with key stakeholders across the sector. Jamie joins SUPR from Sainsbury’s, where he worked in a number of senior investment and property development roles, latterly … Read more

SUPR announces that it has completed the acquisition of three supermarkets in the UK for a total purchase price of £97.6 million, at an average net initial yield of 5.5%1. These acquisitions, comprising well-established stores with long trading histories, have been carefully selected to align with SUPR’s core business strategy and drive further earnings accretion. … Read more

Supermarket Income REIT plc (LSE: SUPR) announces that it is has completed £40.9 million of acquisitions that are accretive to earnings and WAULT across two transactions at an average net initial yield of 6.4%1. Following these transactions the Company has now redeployed £99.8 million of the proceeds of the Company’s strategic joint venture with funds … Read more