Interesting article by The Grocer on the slowdown of growth for the discounters, particularly for Lidl, which has a greater reliance on debt funding.

Aggressive growth strategies have seen many of the better store locations now taken, whilst inflation is also impacting the opening of new stores, as build costs have increased significantly.

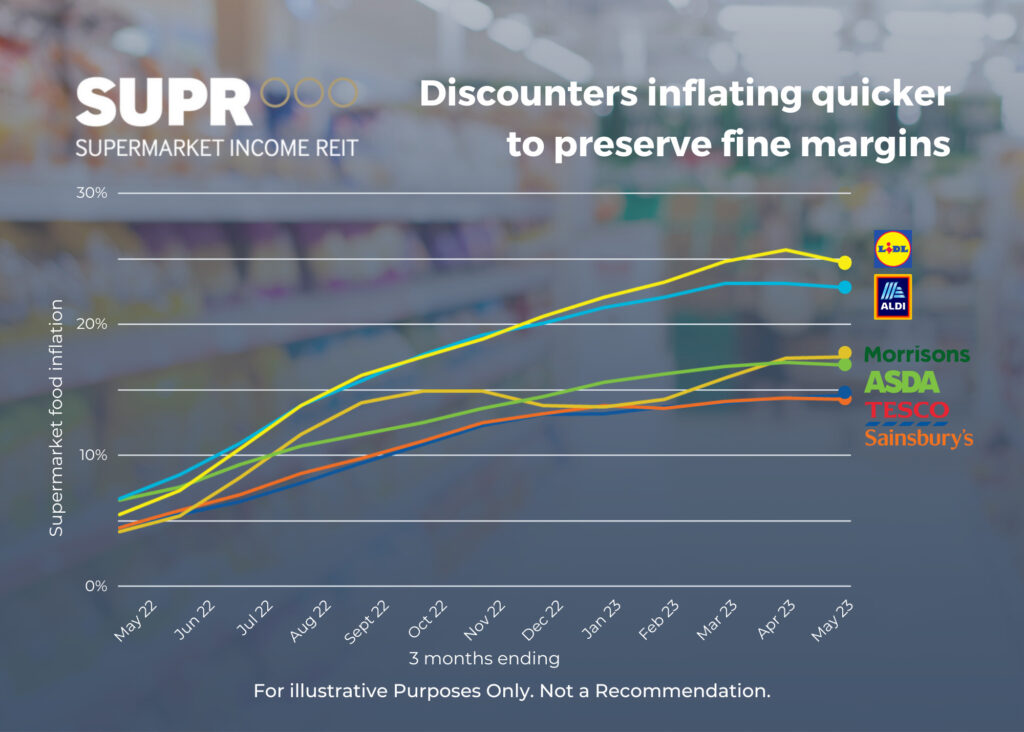

Meanwhile the discounters are having to pass through price increases to consumers quicker than any other major grocer, with price inflation of c.24% as shown in the chart below, as typical margins of around 1% mean that they have less capacity to shield consumers from inflation.

Atrato Group’s Robert Abraham CFA stated “There is a lot of noise in the media around the growth of the discounters making market share gains, but this article highlights how their fine margins make the discounters less agile than the Big 4, with an element of market share gain coming simply through inflating prices quicker”

Read the article here: https://lnkd.in/ebtxv9wY

Data source: Which? Supermarket Inflation Tracker. Inflation is annual, based on three-month periods compared with the same period the previous year.