We are pleased to announce our interim results for the six months ending 31 December 2023.

Our interim report highlights SUPR’s strong balance sheet, resilient financial performance underpinned by continued, structural growth in the grocery sector.

Read our interim results or watch the recording of the results presentation here: https://supermarketincomereit.com/investor-centre/

Keep updated with market and grocery news on our LinkedIn.

“The UK grocery sector continues to demonstrate strong growth up 8% in the Period and forecast to be £250 billion in 2024. . Our tenants continue to grow, strengthening their financial and operational performance by putting omnichannel supermarkets at the heart of their operations.

Our investment strategy continues to focus on acquiring and managing a high-quality portfolio of omnichannel supermarkets, which are critical to our tenants, giving us exposure to what we continue to believe is the largest and fastest growing segment of the grocery market.

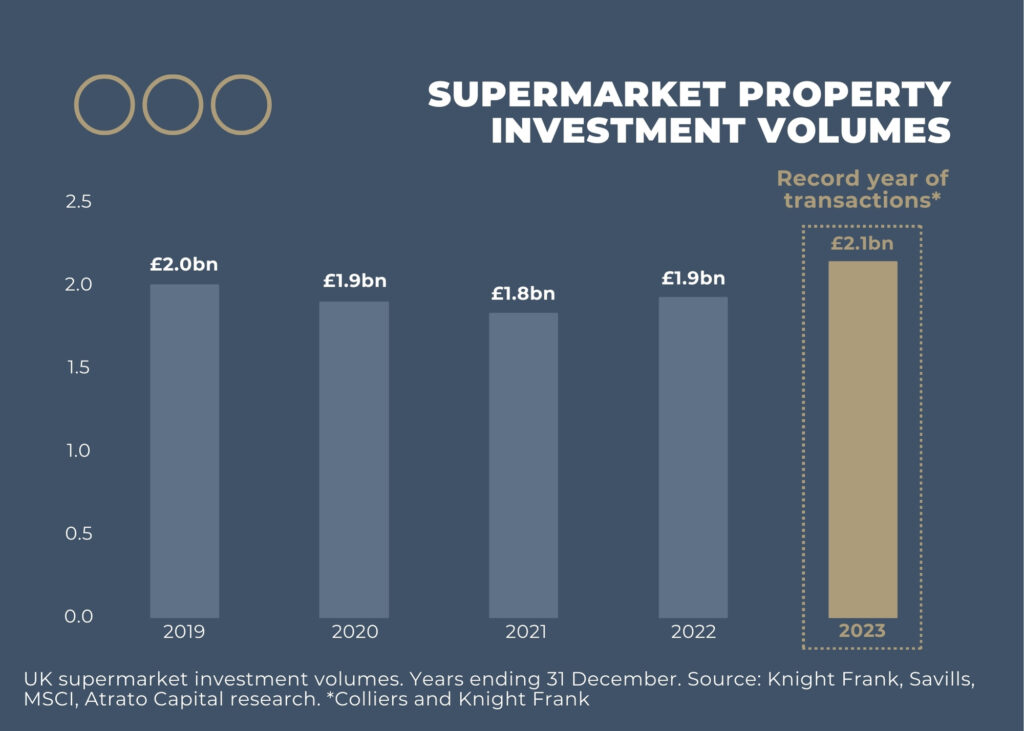

A record £2.1 billion was invested into UK supermarket property in 2023, highlighting the strong appeal of the asset class and the attractiveness of current values.

Looking forward, the quality of our unique supermarket portfolio and the increasing affordability of grocery rents, together with our strong balance sheet means we are well positioned to deliver long-term value for our shareholders.”

Our unique portfolio of 55 mission critical supermarkets, 93% of these stores operate online fulfilment via home delivery and/or click and collect, capturing current and future growth in online sales.

The portfolio has a 13-year weighted average unexpired lease term (“WAULT”), and 78% of rental income is inflation-linked, and 80% from strong performing covenants, Sainsbury’s and Tesco.

Annual sales in the UK grocery market are currently forecast to reach £250 billion in 2024 ; an increase of £65 billion since SUPR’s IPO in 2017.

The sector’s non-discretionary nature highlights its resilience relative to the volatility of the economic cycle. Our tenants have experienced very strong growth in the period with omnichannel strategy is driving increased volumes for our tenants both in-store and online.

2023 was a record year for supermarket real estate investment volumes.

Investment in supermarket property reached £2.1 billion in 2023.. The volume of transactions demonstrates the significant value of supermarket real estate to investors and operators with Tesco and Sainsbury’s, continuing to buy back leasehold stores.

Omnichannel: The future model of UK Grocery.

Omnichannel stores are supermarkets that operate as online fulfilment hubs as well as generating instore physical sales. A typical omnichannel store will operate 25 home delivery vans, with c.200 employees dedicated to online fulfilment, generating up to 30% of store turnover.

These sites, often exceeding 10 acres, have good road transport links in densely populated areas and thus would be very difficult to recreate today. The stores typically have long trading histories, many having been supermarkets for more than 30 or 40 years, underlining the strength of the site as a grocery location.

A key pillar of our investment strategy is to invest in omnichannel stores. These are supermarkets that provide in-store shopping, but also operate as last mile online grocery fulfilment centres for home delivery and click and collect form a key part of the future model of UK grocery.

Read our interim results or watch the recording of the results presentation here: https://supermarketincomereit.com/investor-centre/

Keep updated with market and grocery news on our LinkedIn.