We are pleased to have announced our annual results today for the period ended 30 June 2023.

Our results demonstrate a resilient financial performance with strong income growth, and we have seen the grocery sector’s strength and resilience driving elevated property investment volumes.

“The quality of our portfolio, together with our robust balance sheet means we feel well positioned to deliver long-term value for our shareholders.” – Nick Hewson, Chair

Read the full annual report: https://lnkd.in/gVD_A4h6

Watch the recording of today’s results presentation: https://lnkd.in/eDK3Yt8y

Highlights:

SUPR is the UK’s only listed platform dedicated to investing in UK Grocery.

As reported in our latest Annual Results, we have built a unique portfolio of 55 supermarkets leased to strong performing tenants, including 77% of our income coming from Sainsbury’s and Tesco. Since SUPR’s IPO in July 2017, there has been an 30% overall increase in the UK grocery market to £242 billion*.

78% of our rental income is inflation-linked, subject to caps of 4% per annum on average, supported by a strong balance sheet with 100% of our drawn debt hedged.

*IGD growth from 2022 to 2023 (forecast), June 2023

Omnichannel: The future model of UK Grocery.

SUPR’s portfolio is designed to capture elevated online grocery demand, which is up +80% since June 2019 according to Kantar. Our growing portfolio consists of 93% omnichannel stores.

Omnichannel stores are supermarkets that operate as online fulfilment hubs as well as generating instore physical sales. We understand that these stores are critical to the operations of the UK’s leading grocers such as Sainsbury’s, Tesco, Asda and Morrisons, making our stores vital infrastructure to our tenants. The seamless integration between online and offline fulfilment provides our tenants with economies of scale as well as operational efficiencies.

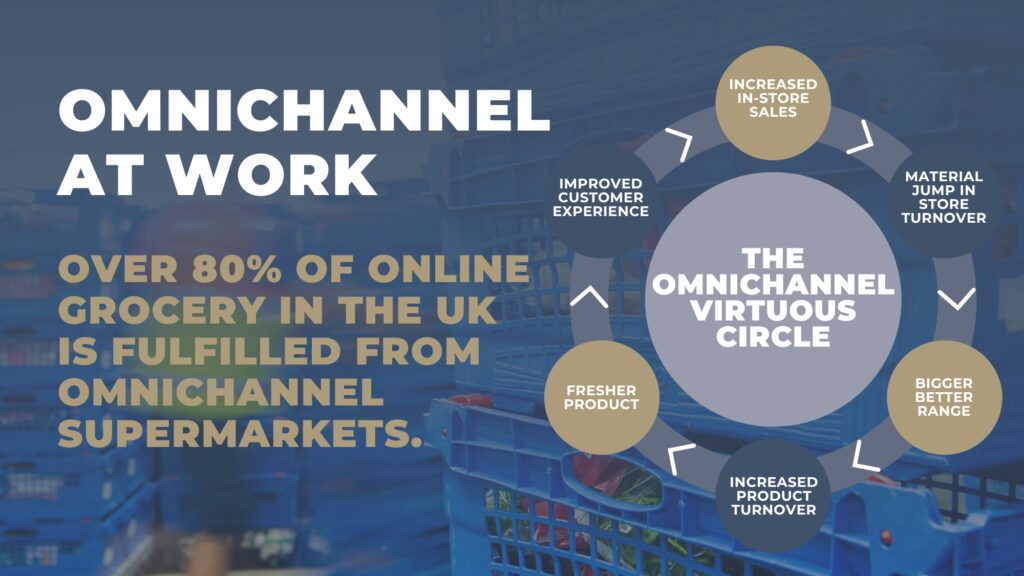

Omnichannel at work: The omnichannel virtuous cycle.

Over 80% of online grocery in the UK is fulfilled from omnichannel supermarkets, and the virtuous cycle enables the combination of in-store and online fulfilment to help deliver increased sales and customer satisfaction.

93% of SUPR’s portfolio consists of omnichannel stores, critical infrastructure for the UK’s largest grocers. These stores give us exposure to the fastest growing segment of the UK grocery market, which is itself experiencing strong growth.

“As we look forward, the quality of our unique omnichannel supermarket portfolio, the increasing affordability of grocery rents, together with our robust balance sheet means we feel confident and well positioned to continue delivering long-term value for our shareholders.” – Nick Hewson, Chair